Maximizing Profits with Forex Trading Robots

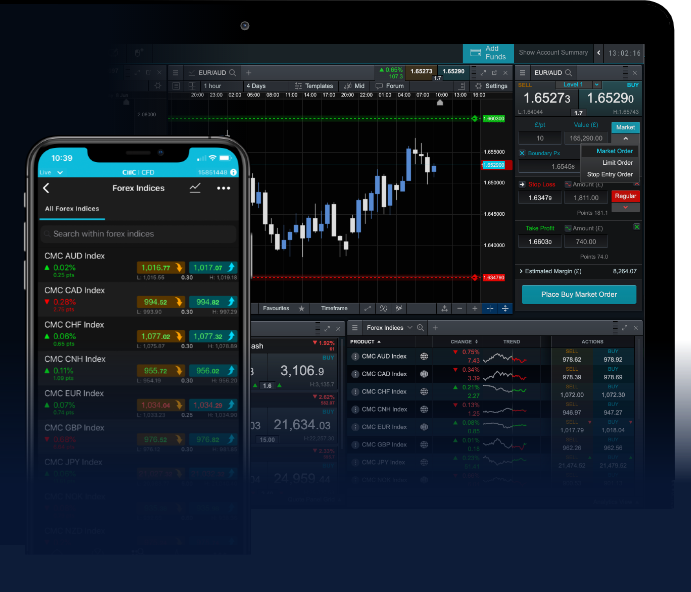

The world of forex trading has evolved dramatically over the years, with technology playing a significant role in its transformation. One of the most significant advancements is the introduction of forex trading robot Trading Platform PK, which offers powerful forex trading robots. These automated systems are designed to analyze market data and execute trades on behalf of the user, eliminating human error and enhancing trading efficiency.

Understanding Forex Trading Robots

Forex trading robots, also known as expert advisors (EAs), are software programs that operate based on a predefined set of rules and algorithms. They can analyze market conditions and execute trades at optimal prices without any human intervention. By relying on a comprehensive database of historical price movements and technical indicators, these robots can predict potential market trends and make informed trading decisions.

How Forex Trading Robots Work

Forex trading robots work by integrating with trading platforms, such as MetaTrader 4 or MetaTrader 5. Once installed, they monitor the forex market 24/5, tracking currency movements and executing trades based on user-defined conditions. The robots can be programmed to manage various aspects of trading, including entry and exit points, stop losses, and take profits. This automated approach allows traders to benefit from market opportunities even when they are not actively watching the charts.

Advantages of Using Forex Trading Robots

- 24/5 Market Monitoring: Trading robots operate around the clock, providing continuous monitoring of the forex market and seizing opportunities that may arise when traders are unavailable.

- Emotionless Trading: One of the most significant challenges traders face is managing emotions. Forex robots eliminate this aspect by executing trades based strictly on predefined rules.

- Consistency: Automated trading systems execute trades based on consistent strategies, reducing the chances of making impulsive decisions that can lead to losses.

- Backtesting Capabilities: Traders can backtest their robots against historical data to evaluate their performance and optimize strategies before deploying them in live environments.

- Time Efficiency: With a forex trading robot managing trades, traders can focus on other aspects of their lives or explore additional trading strategies without the need for constant monitoring.

Choosing the Right Forex Trading Robot

Not all forex trading robots are created equal. When selecting a robot, it’s essential to consider several factors:

- Performance History: Look for transparency in the robot’s performance history. Reliable providers will offer verifiable results from backtesting and live trading.

- User Reviews: Check reviews and feedback from actual users. Forums and trading communities can provide insights into the robot’s effectiveness.

- Strategy Type: Ensure the robot employs a trading strategy that aligns with your trading goals and risk tolerance. Certain robots focus on scalping, while others may employ swing or position trading strategies.

- Support and Updates: A good forex robot provider will offer ongoing support and regular updates to adapt to changing market conditions.

Challenges and Risks of Forex Trading Robots

While forex trading robots offer numerous advantages, they are not without risks and challenges:

- Market Volatility: Sudden market changes can lead to unexpected results. Robots that do not adapt quickly to new conditions may incur significant losses.

- Over-Optimization: There is a risk that traders may optimize their robots too finely on historical data, resulting in poor performance in live trading.

- Technical Failures: Bugs in the software, server downtime, or internet connection issues can lead to missed trades or erroneous executions.

- Lack of Adaptability: Some robots may struggle to adapt to changing market conditions or new trading environments.

Best Practices for Using Forex Trading Robots

To maximize the benefits of forex trading robots while minimizing risks, consider the following best practices:

- Demo Testing: Always test your robot on a demo account before deploying it in live trading. This helps you understand its operation and performance without risking real capital.

- Regular Monitoring: Despite the automation, it is crucial to monitor your robot’s performance regularly to ensure it behaves as expected and to make adjustments as needed.

- Diversification: Avoid relying on a single trading robot. Diversifying across multiple strategies and robots can help spread risk and enhance overall performance.

- Continuous Learning: Stay informed about market trends and changes in economic factors. This knowledge will help you understand potential impacts on your trading strategies.

Conclusion

Forex trading robots have ushered in a new era of trading, providing automated solutions that can improve efficiency and profitability. By understanding how these systems work, their advantages, and the risks involved, traders can make informed decisions about integrating robots into their trading strategies. As with any trading method, a balanced approach that combines automation with human oversight will yield the best results.